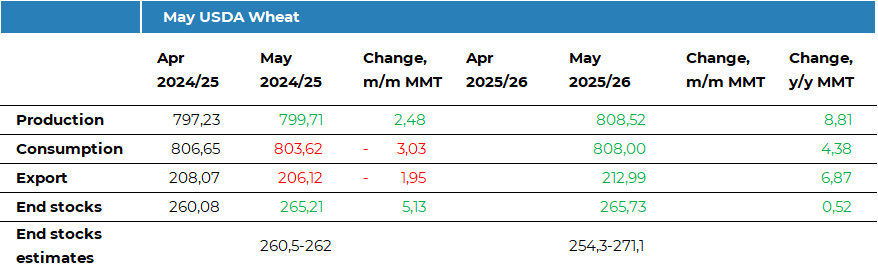

Травневий

звіт USDA WASDE задав ведмежий тон для ринку пшениці, спрогнозувавши рекордне

світове виробництво у 2025/26 МР — 808,5 млн тонн, що на 8,8 млн тонн більше у

річному вимірі. Зростання зумовлене суттєвими приростами в ЄС (136 млн т,

+13,9), Аргентині (20 млн т, +1,5), росії (83 млн т, +1,4) та Канаді (36 млн т,

+1). Ці прирости більш ніж компенсують скорочення виробництва в Казахстані

(14,5 млн т, -4,1), Австралії (31 млн т, -3,1) та США (52,3 млн т, -1,4).

Незважаючи на річне зниження, показник для США перевищив очікування ринку.

Урожай

пшениці в Україні у 2025/26 МР оцінюється на рівні 23 млн тонн — лише трохи

нижче за минулорічний, але суттєво вище за прогноз FAS USDA (17,9 млн т), який

ще не враховує оновлені площі озимої пшениці. Для поточного 2024/25 сезону

прогноз врожаю в ЄС було підвищено на 1,1 млн т м/м — до 122,1 млн тонн.

Світовий

експорт пшениці у 2025/26 МР прогнозується на рівні 213 млн тонн, що на 6,9 млн

тонн більше, ніж торік. Основне зростання припадає на ЄС — до 34 млн т (+7,5).

Також очікується зростання експорту з Аргентини (13 млн т, +2), росії (45 млн

т, +1,5) та України (16,5 млн т, +0,5). Натомість, Австралія (23 млн т, -2) та

Казахстан (8 млн т, -2) скоротять обсяги. Експорт США прогнозується на рівні

21,8 млн тонн (-0,6), оскільки глобальна конкуренція й далі обмежує попит на

американську пшеницю.

У

2024/25 МР прогноз експорту Канади підвищено на 0,5 млн т — до 27 млн т.

Натомість оцінки для росії (43,5 млн т), Австралії (25 млн т) та Аргентини (11

млн т) знижено на 0,5 млн т кожна.

Щодо

попиту, імпорт пшениці Китаєм у 2025/26 МР прогнозується на рівні 6 млн тонн —

майже вдвічі більше порівняно з 3,3 млн т поточного сезону (цей показник було

знижено на 0,2 млн т м/м).

Світові

кінцеві запаси пшениці у 2025/26 МР оцінюються на рівні 265,7 млн тонн — на 0,5

млн т більше, ніж торік, і вище середніх ринкових очікувань. У США запаси

зростуть до 25,1 млн тонн (+10% р/р) — найвищого рівня за останні шість років,

що лише посилює ведмежий настрій. Для 2024/25 МР прогноз світових кінцевих

запасів підвищено на 5,1 млн т м/м — до 265,2 млн тонн.

Загалом,

звіт виявився ведмежим для ринку пшениці: більші, ніж очікувалося, врожай і

запаси в США, рекордне світове виробництво, розширення експорту та зростання

кінцевих запасів чинять тиск на ціни на CBOT. Якщо не станеться значних

погодних потрясінь, глобальна пропозиція пшениці виглядає більш ніж достатньою

у 2025/26 МР.

Детальний

огляд інших культур доступний для передплатників ASAP Agri Premium: https://asapagri.com/products/premium.

Прокоментувати