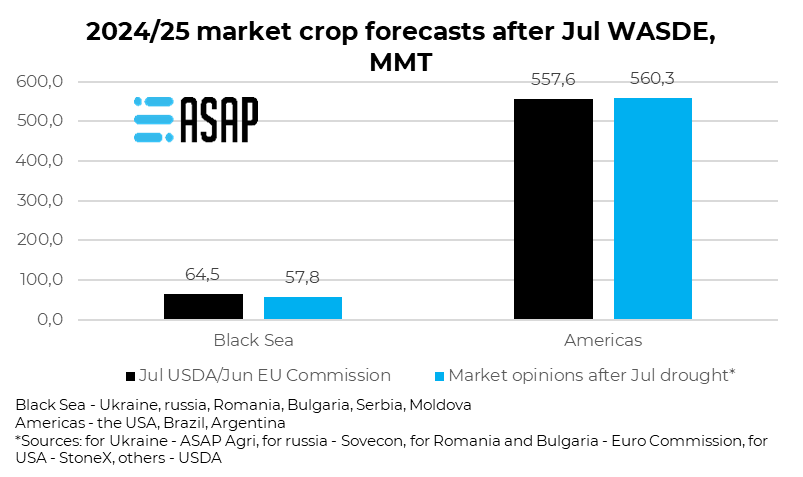

Причорноморський регіон уже втратив значну частку свого потенціалу виробництва кукурудзи після того, як у липні регіон вразили сильна посуха та відсутність опадів, що знизило перспективи врожайності культури.

Нещодавно ряд місцевих агентств переглянули свої прогнози щодо врожаю кукурудзи у своїх країнах. ASAP Agri знизили свій прогноз врожаю кукурудзи в Україні в 2024 році на 5,2 млн тонн - до 24,1 млн. тонн, що на 21% нижче, ніж минулого року, тоді як УЗА знизила його на 2,1 млн тонн - до 23,4 млн тонн, також -21% р/р (-6,2 млн тонн).

Sovecon знизив свої очікування щодо російського врожаю 2024 року на 1,2 млн тонн - до 13,4 млн тонн, тоді як липневий WASDE був на рівні 15 млн тонн.

Єврокомісія також знизила свої прогнози щодо врожаю кукурудзи в Румунії та Болгарії на 2024 рік. Прогноз для Румунії було скорочено на 1,1 млн тонн - до 9,5 млн тонн (-10% р/р), а для Болгарії - на 0,4 млн тонн до 2,6 млн тонн (+8% р/р).

Ми не виключаємо, що ми можемо побачити відповідні коригування в серпневому WASDE наступного понеділка. Але питання в тому, чи відчує світовий ринок ці втрати в Причорномор'ї.

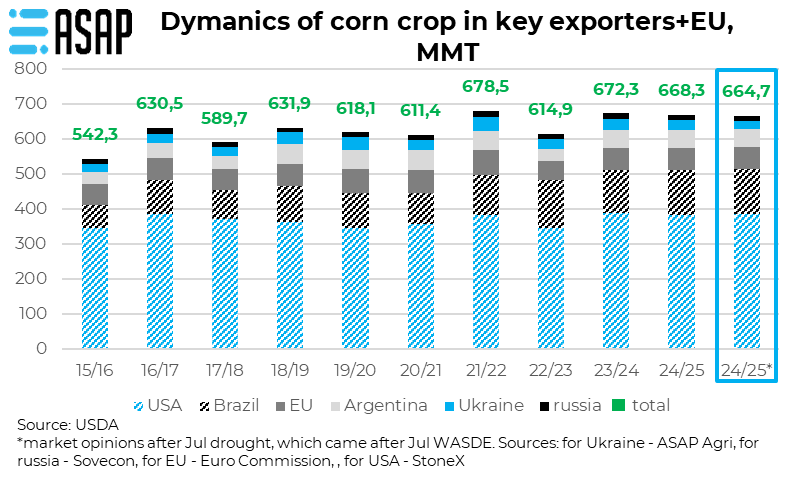

США можуть зібрати менший урожай кукурудзи в 2024/25 МР. Останній прогноз виробництва від USDA становить 383,6 млн тонн, що на 2% менше р/р, що є 3-м найвищим показником в історії США. Крім того, нинішній стан посівів хороший, а погода в прогнозах сприятлива. Так, минулого тижня StoneX озвучив свій прогноз урожаю на рівні 15,207 млрд буш (386,3 млн тонн), що на 107 млн буш (2,7 млн тонн) вище за прогноз USDA через кращі перспективи врожайності культурі. Якщо прогноз StoneX справдиться, врожай стане 2-м за всю історію США.

Також менше кукурудзи буде в Бразилії. У країні зараз збирають урожай 2023/24 МР, а врожайність кукурудзи другого врожаю досить неоднорідна. USDA прогнозує, що врожай у Бразилії у 2023/24 МР становитиме 122 млн тонн, що значно нижче рекордних 137 млн тонн минулого сезону (-11% р/р). Тим не менш, обсяг буде другим за розміром в історії країни. Минулого тижня StoneX озвучив свій прогноз урожаю у Бразилії у 2023/24 МР на рівні 121,8 млн тонн.

В Аргентині врожай кукурудзи відновиться після минулорічних втрат. USDA прогнозує його у 2023/24 МР на рівні 52 млн тонн проти 36 млн тонн рік тому, тобто +44% р/р.

Таким чином, ми побачимо зменшення поставок кукурудзи з ключових країн-експортерів, але обсяги залишаться історично високими. Водночас попит з боку деяких основних покупців може бути стриманим. USDA очікує імпорт Китаю в 2024/25 МР на рівні 23 млн тонн, що на рівні попереднього року.

Попит з боку ЄС викликає сумніви. Зараз USDA оцінює його на рівні 18 млн тонн, порівняно з 20,5 млн тонн за рік. Однак нещодавнє зниження прогнозу врожаю Єврокомісією на 1,9 млн тонн за місяць до 62,9 млн тонн може призвести до перегляду прогнозу імпорту ЄС у бік підвищення.

Для України також важливо бачити попит з боку Єгипту та Туреччини. Для Єгипту поточний прогноз USDA становить 8 млн тонн на 2024/25 МР, що на 7% більше, ніж у минулому році. У свою чергу Туреччина може скоротити імпорт на 40% р/р до 1,8 млн тонн.

Додаткові візуалізації будуть доступні для підписників Premium на ASAP Agri в наступному випуску Тижневика. Підпишіться на ASAP Agri Premium тут info@asapagri.com

Прокоментувати