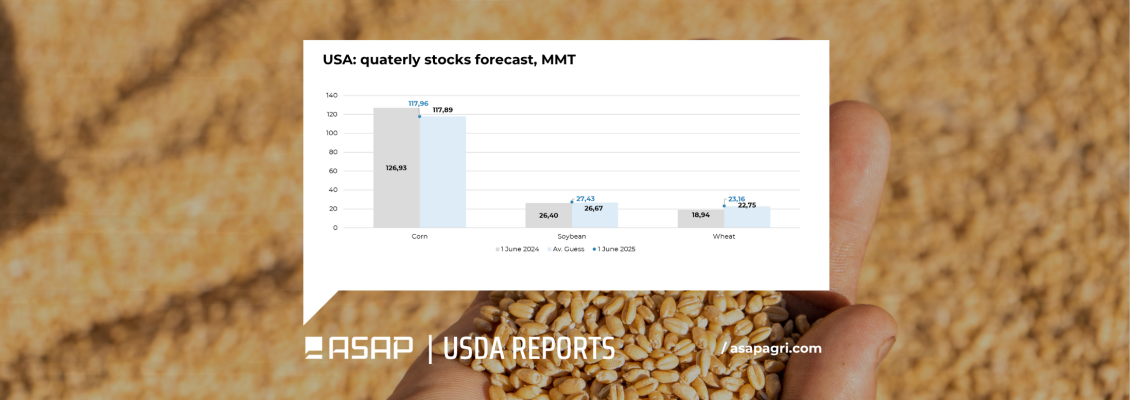

Квартальний звіт USDA щодо запасі зерна в США станом на 1 червня, опублікований 30 червня, не приніс суттєвих сюрпризів, однак посилив тиск на пшеничний ринок, оскільки обсяги запасів перевищили очікування. Кукурудза також подешевшала — попри те, що звітні цифри збіглися з прогнозами, вони не надали ринку нової підтримки. Щодо сої, то попри вищі за очікування запаси, ф’ючерси торгувалися різноспрямовано — з незначними зростаннями або втратами залежно від контракту, адже ринок проігнорував негативний сигнал на фоні трохи нижчих площ посіву.

Кукурудза: запаси чинять тиск попри відповідність прогнозам

Станом на 1 червня 2025 року запаси кукурудзи в США склали 117.96 млн тонн — близько

до очікувань трейдерів, але менше ніж 126.93 млн тонн рік тому. Хоча цифра

підтвердила скорочення пропозиції порівняно з минулим роком, це не допомогло

цінам — вони продовжили зниження на фоні очікувано сильного врожаю.

Соя: ринок переважно ігнорує дещо ведмежий результат

Запаси сої оцінено в 27.43 млн тонн — більше ніж 26.4 млн тонн торік і вище

прогнозу трейдерів на рівні 26.67 млн тонн. Тим не менш, ринок не відреагував

суттєво — ф’ючерси залишалися майже незмінними: деякі контракти демонстрували

легке зростання, інші — помірні втрати. Трейдери в основному проігнорували

збільшені запаси, зосередившись на незначному зниженні посівної площі та

технічному відновленні після різкого падіння минулого тижня.

Пшениця: запаси перевищили очікування, посилюючи ведмежий настрій

Запаси пшениці склали 23.16 млн тонн, що перевищує середній прогноз ринку

(22.75 млн тонн) і значно вище за торішні 18.94 млн тонн. Це лише посилило

побоювання щодо надмірної пропозиції на світовому ринку та додало тиску на вже

слабкий пшеничний сегмент.

Підсумок:

звіт USDA щодо запасів зерна на 1 червня був сприйнятий як нейтральний до

помірно ведмежого для кукурудзи, ведмежий для пшениці та помірно ведмежий для

сої.

Огляд репорту щодо посівних площ в США доступний для передплатників ASAP Agri Premium: https://asapagri.com/products/premium.

Прокоментувати