Після

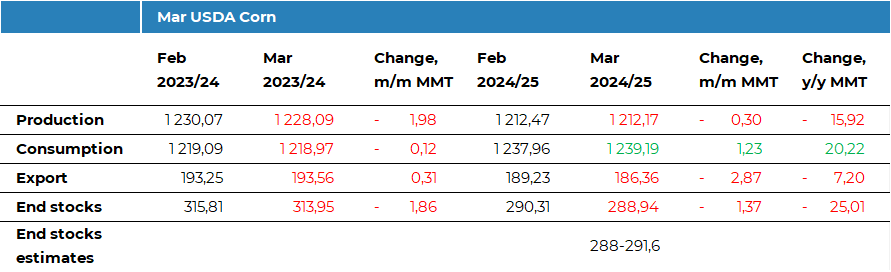

публікації березневого звіту WASDE ф’ючерси кукурудзи на CBOT трохи зросли,

оскільки світові кінцеві запаси кукурудзи були знижені на 1,4 млн тонн до 288,9

млн тонн, що нижче середнього рівня очікувань. Тим часом запаси кукурудзи в США

залишились без змін, попри очікування ринку на їх зниження. Це скорочення було

здійснене через переоцінку балансу на 2023/24 МР. Прогноз врожаю на 2023/24 МР

для Бразилії знижено на 3 млн тонн до 119 млн тонн, а для Аргентини підвищено

на 1 млн тонн до 51 млн тонн. У той же час світове виробництво кукурудзи на

2024/25 МР було знижено лише на 0,3 млн тонн до 1,212 млрд тонн, при цьому зменшення

на 1 млн тонн для Південної Африки до 16 млн тонн було компенсовано підвищенням

прогнозу для росії (+0,75 до 14 млн тонн) і України (+0,3 до 26,8 млн тонн).

Світовий

експорт кукурудзи на 2024/25 МР знижено на 2,9 млн тонн до 186,4 млн тонн.

Прогноз експорту Бразилії знижено на 2 млн тонн до 44 млн тонн на основі відвантажень

на поточний момент. Прогноз експорту Південної Африки знижено на 0,9 млн тонн

до 1,7 млн тонн.

Прогноз

імпорту кукурудзи Китаєм знову знижено, цього разу на 2 млн тонн до 8 млн тонн

для 2024/25 МР, що було очікувано.

Звіт

сприймається як переважно нейтральний, без змін у балансі кукурудзи США та з

очікуваним зниженням імпорту Китаєм.

Детальний

огляд інших культур доступний для передплатників ASAP Agri Premium Outlook: https://asapagri.com/products/premium.

Прокоментувати