Генеральний

директор ASAP Agri Христина Серебрякова в інтерв’ю Latifundist розповіла, як

тарифні війни Дональда Трампа можуть змінити ринки кукурудзи, сої та ріпаку та

що це означає для українських виробників.

Питання: Сполучені Штати запровадили мита на імпорт

із Канади, Мексики (відкладені до квітня) та Китаю, а наступною може стати

Європа. Як це вплине на світові ринки?

Христина Серебрякова: Нові американські мита та заходи у

відповідь спричинили значну невизначеність на фінансових ринках. Наш керівник

відділу аналітики Олів'є Буїє зазначає, що головною загрозою для США є

інфляція, що викликає побоювання щодо економічної стабільності. В результаті

індекс S&P 500 і курс долара США впали нижче рівнів листопада 2024 року, що

передували виборам.

Вплив на аграрні

ринки залежить від реакції постраждалих країн. Торговельна війна, схожа на

конфлікт 2018 року, тепер охоплює не лише Китай, а й Мексику та Канаду,

змінюючи торговельні потоки.

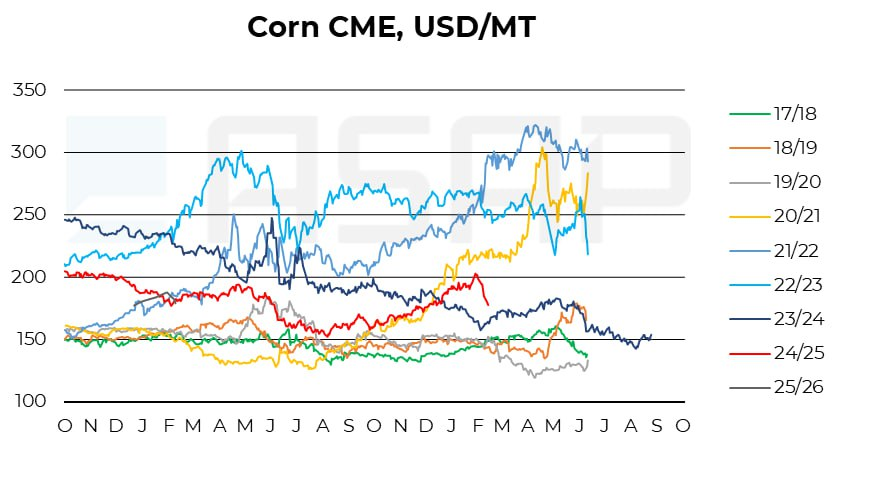

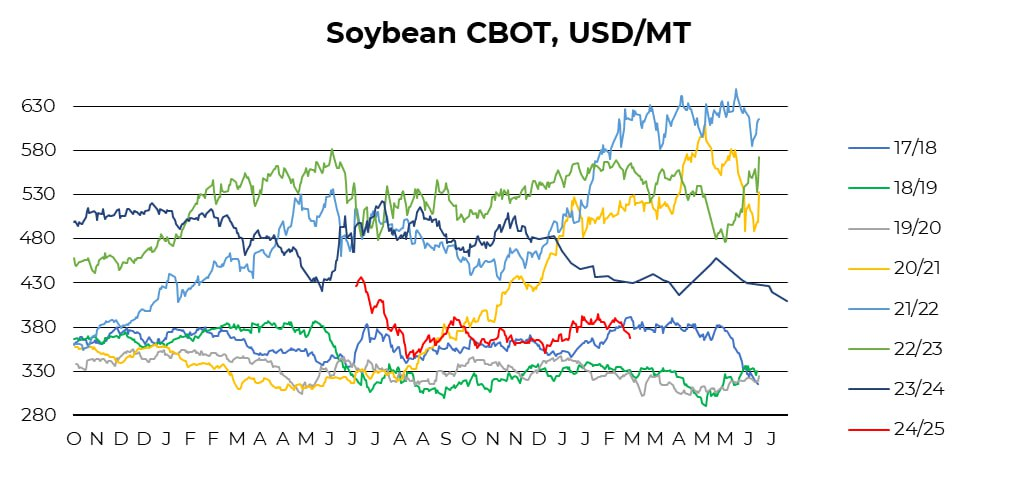

4 березня 2025 року ф’ючерси

на кукурудзу на Чиказькій біржі CBOT опустилися до найнижчого рівня з грудня

2024 року, тоді як ціни на сою знизилися до мінімуму з січня 2025 року під

тиском нових мит.

Питання: Деякі

аналітики вважають, що Бразилія стане найбільшим вигодоотримувачем, замінивши

американську кукурудзу та сою в Китаї. Чи згодні ви?

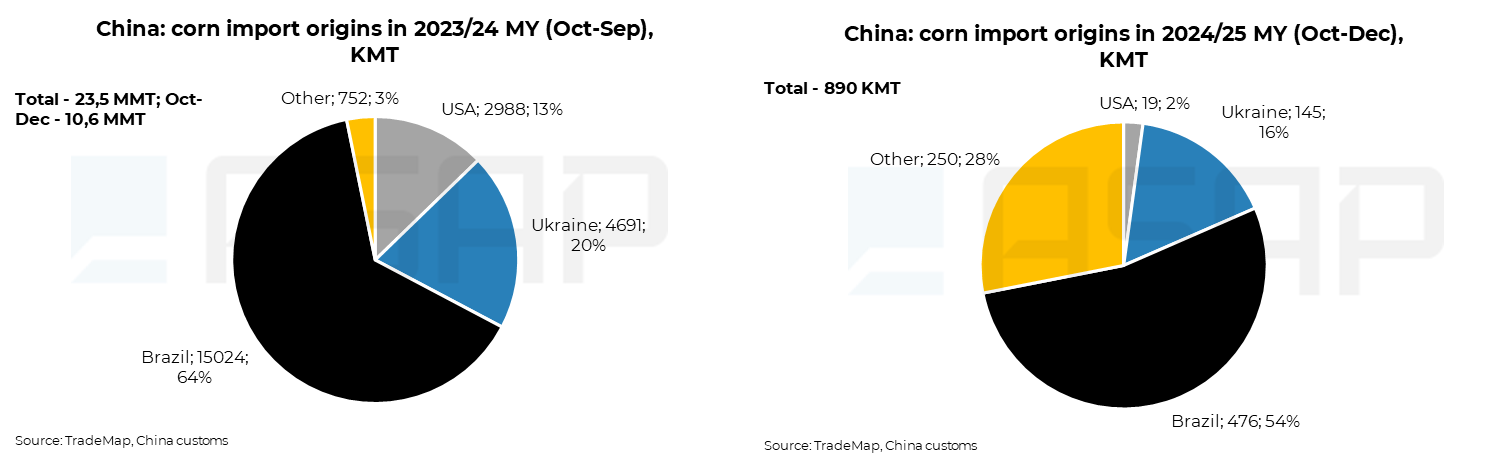

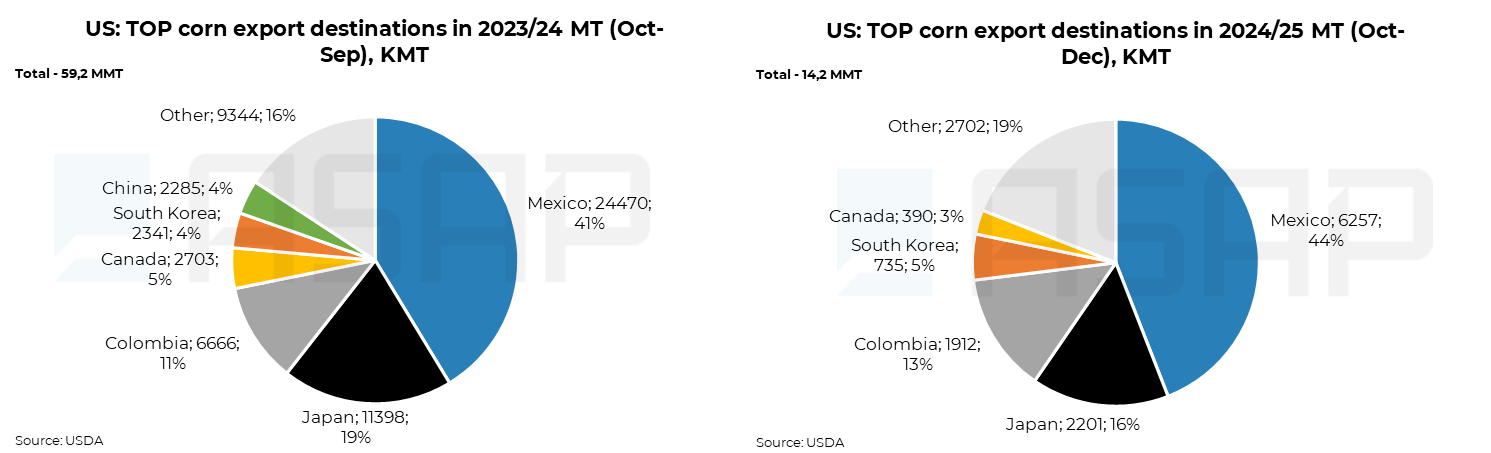

Щодо кукурудзи, поки що немає чітких переможців. Американська кукурудза вже втратила позиції в Китаї, оскільки в останні місяці закупівлі були млявими, а Бразилія зайняла цю нішу. Деякі аналітики прогнозують, що імпорт кукурудзи до Китаю може скоротитися майже до 5 млн тонн у 2024/25 МР. Щодо експорту кукурудзи до Мексики – це окрема тема, яка значною мірою залежить від логістичної конкурентоспроможності Бразилії.

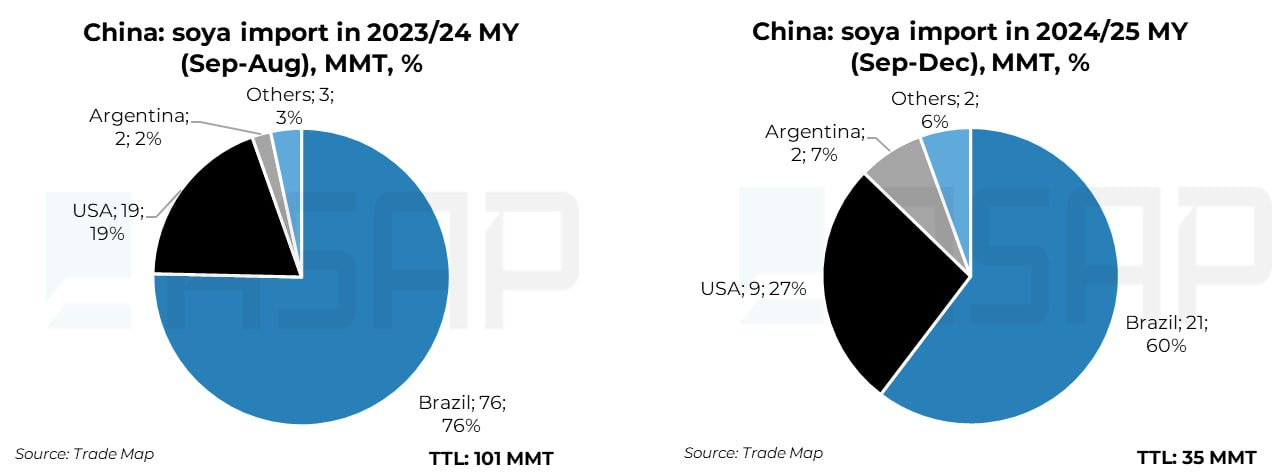

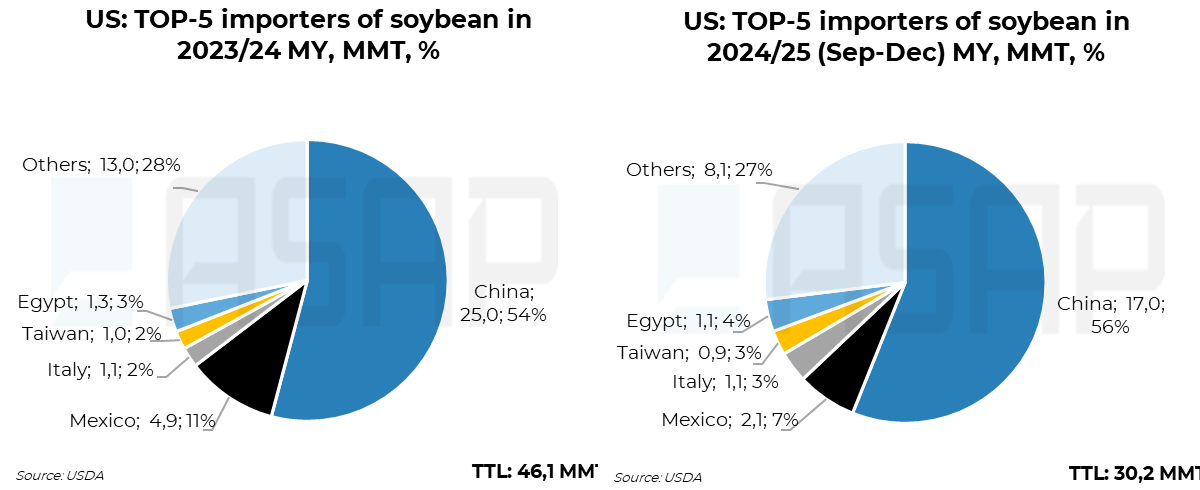

Щодо сої, Бразилія

дійсно має значні переваги. Минулого сезону США поставили 19 млн тонн сої до

Китаю, що становило 19% загального імпорту країни. З урахуванням великого

врожаю сої в Бразилії та її тісних зв’язків із Китаєм, вона добре підготовлена

до цього зрушення.

Питання: Чи може

Мексика, найбільший покупець американської кукурудзи, переорієнтуватися на

бразильські поставки?

Якщо торговельні обмеження

залишатимуться чинними, Мексика – найбільший імпортер кукурудзи у світі – може

скоротити закупівлі у США. Бразилія може стати альтернативним постачальником,

проте залишаються значні логістичні виклики.

Залізнична

інфраструктура США забезпечує значну перевагу у витратах. За даними Ouro Safra,

Мексика періодично закуповує бразильську кукурудзу, але ефективність

залізничних перевезень робить масштабний перехід малоймовірним. Хуліо Ломбарді

з Biond Agro зазначає, що всі поставки бразильської кукурудзи до Мексики

здійснюються морем, що значно підвищує їхню вартість порівняно з

відвантаженнями зі США.

Питання: Які контрзаходи можуть вжити Канада та

Мексика?

Ситуація залишається невизначеною. 7 березня Дональд Трамп відклав

запровадження 25% мит на значну частину імпорту з Мексики та деяких товарів з

Канади на місяць через побоювання щодо економічних наслідків ширшої

торговельної війни.

Якщо мита набудуть чинності у квітні, Мексика, ймовірно, матиме

більше шансів замістити американську кукурудзу, ніж Канада знайти нові ринки

збуту для канолової олії. 90% канадської каноли експортується у вигляді насіння

та продуктів переробки, а США традиційно є основним покупцем, поглинаючи 90%

експорту канолової олії.

Питання: Канадська

канолова галузь розглядає можливість переорієнтації експорту до Європи. Чи

становить це загрозу для українського ріпаку?

Якщо торговельні бар’єри залишаться, Канада може зіткнутися з

надлишком каноли, що тиснутиме на ціни в Вінніпезі та на біржі Euronext.

Головним конкурентом України на ринку ріпаку в ЄС залишається

Австралія. Однак імпорт канадського ріпаку до Європи вже зріс у вісім разів

цього сезону. Наші дані свідчать, що європейські олійноекстракційні заводи

переробляють переважно ріпак уже близько двох місяців, і найближчим часом

очікується надходження нових партій з Канади.

Тим часом Австралія відновила доступ до ринку ріпаку Китаю у травні 2022 року після дворічної заборони через питання якості. Повернувшись на китайський ринок, Австралія може змусити Канаду активізувати конкуренцію в Європі.

Питання: США, здається, завдають шкоди власним аграрним виробникам. Які альтернативні ринки вони можуть знайти?

Я обговорювала це з Меттом Амерманном, керівником з управління ризиками StoneX. Він вважає, що американська кукурудза вже адаптувалася до відсутності китайського попиту, а Мексика залишатиметься ключовим ринком принаймні до літа, коли на ринок вийде бразильська пропозиція.

Щодо сої, Метт підтвердив нашу оцінку, що США переорієнтуються на

ринки Близького Сходу. Тим часом українська кукурудза зіштовхується з

найжорсткішою конкуренцією цього сезону.

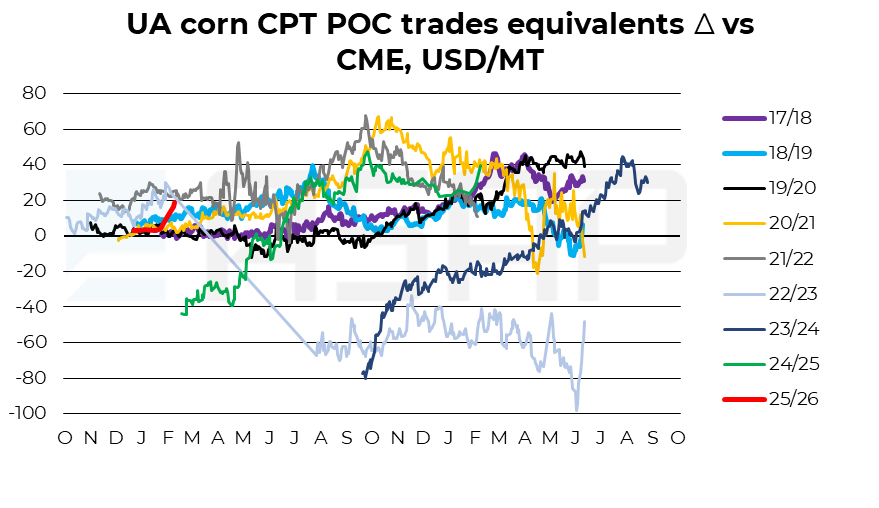

Станом на 5 березня

спред між українською кукурудзою на базисі CPT POC та ф'ючерсами CME досяг 40

USD/т—рівня, востаннє зафіксованого на початку сезону. Це стало наслідком

перегріву українського ринку CPT у лютому та тиску на ціни в США через тарифну

політику Трампа. Для порівняння, на початку січня спред скоротився майже до 20

USD/т, що спричинило хвилю контрактів на січнево-лютневі поставки.

Щодо сої, станом на 5 березня спред між українською CPT POC та CME досяг 20 USD/т, тоді як у січні 2025 року він був нульовим.

Питання: Трамп закликав фермерів готуватися до

збільшення внутрішніх продажів. Чи означає це зсув у бік біоетанолу?

Трамп не уточнив,

про які зернові культури йдеться, а згадав сільськогосподарську продукцію

загалом. Брак деталей залишає простір для трактувань.

Один із можливих

сценаріїв – стимулювання фермерів США до збільшення виробництва для

внутрішнього ринку, оскільки імпортна продукція дорожчатиме через мита.

Водночас його заява — "Готуйтеся виробляти багато сільськогосподарської

продукції для продажу ВНУТРІШНЬО в США" — може свідчити про намір уряду

перенаправити надлишкові експортні запаси на внутрішній ринок.

Якщо це так, ринок США може зіткнутися з

напливом вітчизняної кукурудзи, що потенційно сприятиме зростанню виробництва

біоетанолу. Хоча Трамп не є прихильником «зеленої» енергетики, він змушений

балансувати між підтримкою нафтового сектору та фермерів Середнього Заходу –

двох ключових виборчих груп. Підвищення обов’язкових норм щодо біоетанолу в

кукурудзовиробничих штатах із одночасними поступками для нафтової галузі може

стати компромісним рішенням.

Як ці події впливають на Україну?

По-перше, вони

чинять тиск на зниження цін на кукурудзу та сою на світовому ринку.

Мексика щорічно

імпортує до 23 мільйонів тонн кукурудзи зі США. Навіть якщо Бразилія замінить

частину цього обсягу, принаймні 11 мільйонів тонн надлишкової кукурудзи зі США

може потрапити на світові ринки. Торговельна матриця ASAP Agri, представлена на

Global Grain 2024, показує, що цей обсяг еквівалентний загальним експортам

бразильської кукурудзи до Північної Африки та Близького Сходу.

Якщо кукурудза з

США та Бразилії почне взаємно заміщувати одна одну, українські експортери все

одно можуть зіткнутися з проблемами. Наразі кукурудза з США пропонує дуже

конкурентні ціни для Північної Африки, але ходять чутки про деякі проблеми з

якістю останніх поставок зі США. З 26 лютого 2025 року, коли адміністрація

Трампа оголосила про намір ввести 25% мита на імпорт із Європейського Союзу,

європейські покупці неохоче купують американське зерно через побоювання щодо

можливих обмежень. Крім того, запаси кукурудзи в ЄС залишаються високими, що ще

більше обмежує попит.

Щоб отримати більше інформації про потенційні зміни на

українському ринку зерна через тарифи Трампа, Христина Серебрякова, генеральний

директор ASAP Agri, поділиться детальним аналізом під час панельної дискусії на

конференції EuroGrainExchange 2025, яка відбудеться 10-11 квітня в Бухаресті.

Записуйте дату!

Прокоментувати