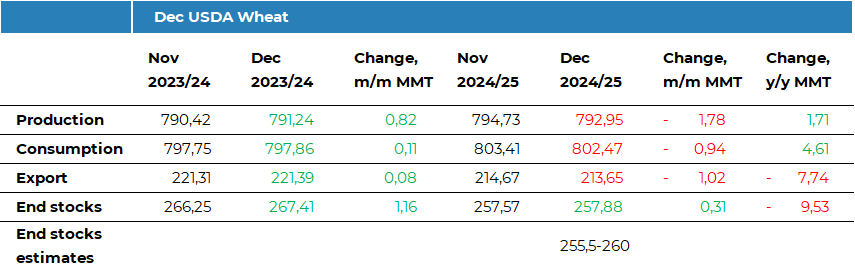

Грудневий звіт WASDE знизив оцінку світового

виробництва пшениці на 2024/25 МР на 1,8 млн тонн до 793,0 млн тонн, при цьому

основні коригування були зроблено для ЄС та Бразилії. Зокрема, оцінка врожаю

пшениці в ЄС була знижена на 1,3 млн тонн до 121,3 млн тонн через "зниження виробництва в кількох

країнах-членах". Виробництво пшениці в Бразилії було скорочено на 0,4 млн

тонн до 8,1 млн тонн.

Прогноз світового експорту пшениці на 2024/25

МР було знижено на 1,0 млн тонн до 213,7 млн тонн, оскільки скорочення прогнозів

для ЄС та росії нівелювало покращення перспектив експорту з США та України.

Прогноз для росії був знижений на 1,0 млн тонн до 47,0 млн тонн, оскільки

"введення експортної квоти, ймовірно, обмежить експорт до кінця маркетингового року". Експортний потенціал ЄС був знижений на 1,0 млн тонн

до 29,0 млн тонн. Також експортний потенціал Бразилії був знижений на 0,2 млн

тонн до 2,7 млн тонн. У свою чергу, прогноз для України був підвищений на 0,5

млн тонн до 16,5 млн тонн, що перевищує офіційно встановлений ліміт експорту

пшениці в 2024/25 МР у 16,2 млн тонн. Прогноз для США був підвищений на 0,7 млн

тонн до 23,1 млн тонн. Тим часом імпорт пшениці в Китай був знижений ще на 0,5 млн

тонн до 11,0 млн тонн.

Глобальне споживання пшениці на 2024/25 МР

було знижено на 0,9 млн тонн до 802,5 млн тонн.

Глобальні кінцеві запаси були збільшені на

0,3 млн тонн до 257,9 млн тонн, що все ще є найнижчим рівнем з 2015/16 МР, що трохи вище середнього рівня очікувань у 257,6 млн тонн. Запаси в США були

знижені на 0,5 млн тонн до 21,6 млн тонн, що нижче очікувань.

Загалом, звіт підтримав ціни на

пшеницю на CBOT, які зросли після його публікації. Підтримку також надає сегмент

кукурудзи, де ціни суттєво підвищилися після публікації звіту.

Прокоментувати