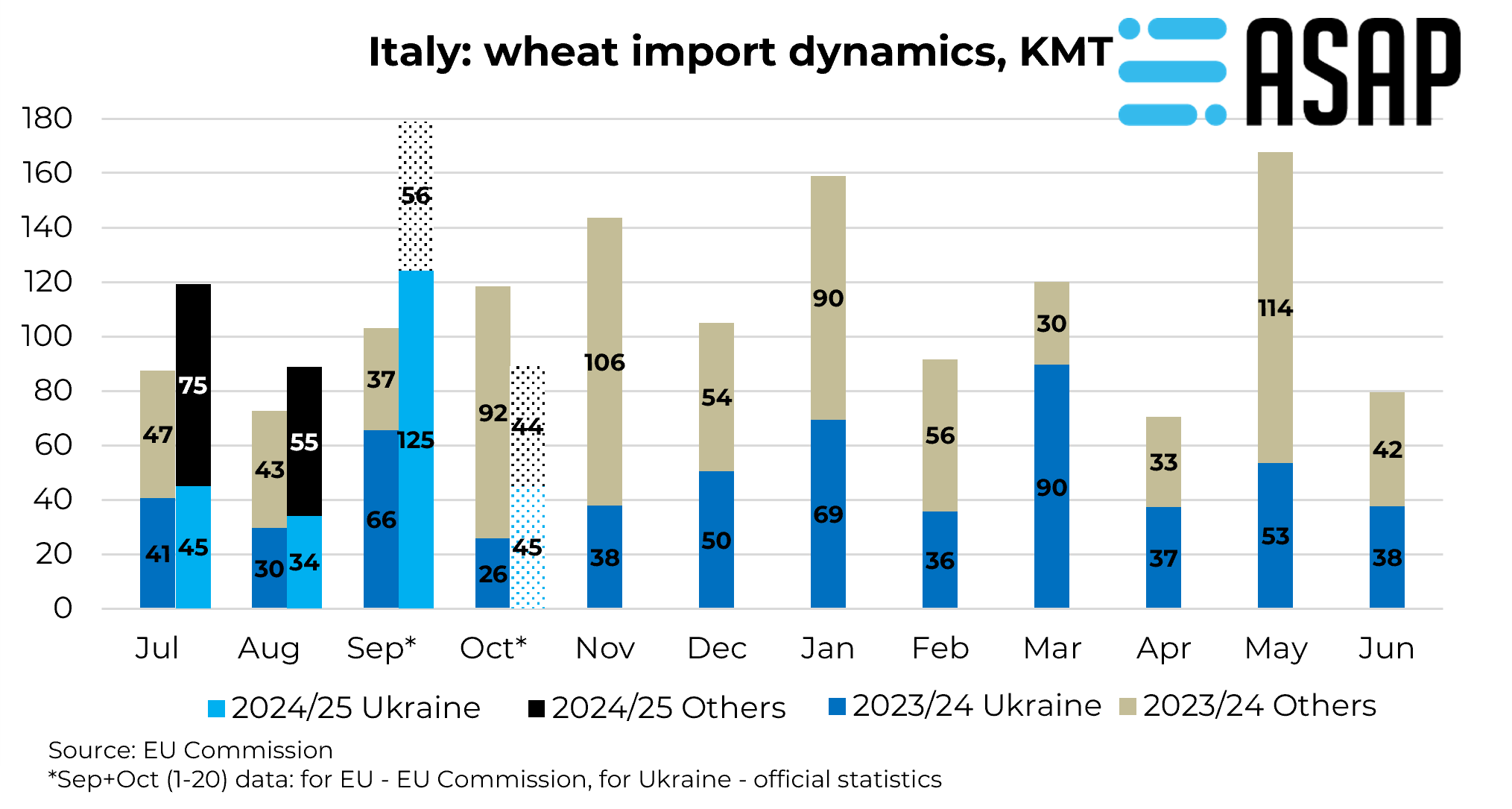

У вересні 2024 р. Україна експортувала до Італії 124 тис. тонн пшениці, що стало найбільшим обсягом з листопада 2022 р. Це зростання обсягів було обумовлено виконанням контрактів, укладених у липні та серпні. Однак у жовтні обсяги поставок різко зменшилися. Дійсно, у вересні та жовтні покупці зменшили активність укладання контрактів, що свідчило про відносно низький попит.

Команда ASAP Agri вирішила проаналізувати ціни на пшеницю на ринку Італії та виявила, що з кінця вересня ціни на місцевій біржі Барі зросли приблизно на 20 USD/т з. Наступним кроком стало оцінювання того, наскільки ці ціни можна використовувати для розрахунку рівнів закупівель на умовах CIF для Східного узбережжя Італії. (графік з цінами доступний підписникам ASAP Weekly Premium).

Як зазначила Тетяна Винник, брокер Atria Brokers, цю цінову динаміку необхідно аналізувати доволі обережно. «Варто зазначити, що ціна на графіку біржі Барі є котируванням, запропонованим тиждень тому для невеликої партії. Для точного розрахунку вартості на умовах CIF Східне узбережжя Італії потрібно відкоригувати біржову ціну з урахуванням витрат на розвантаження судна, транспортування від порту до млина та прибутку імпортера», – пояснила вона.

Прокоментувати