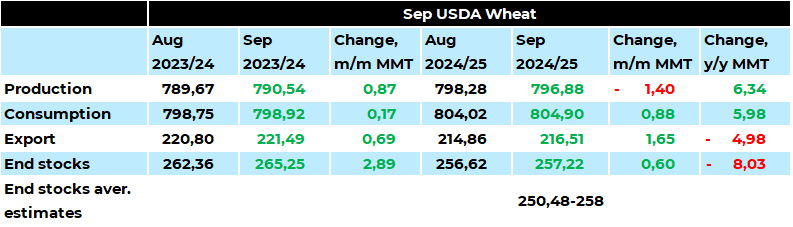

Вересневий WASDE скоротив світове виробництво пшениці у 2024/25 МР на 1,4 млн тонн до 796,9 млн тонн, що все ще є рекордом. Урожай в Австралії збільшено на 2 млн тонн до 32 млн тонн «за сприятливих погодних умов у Західній Австралії, Новому Південному Уельсі та Квінсленді». Прогноз наразі близький до 31,8 млн тонн, нещодавно озвучених ABARES. Виробництво в Україні підвищено на 0,7 млн тонн до 22,3 млн тонн «на основі даних, оприлюднених АгМіном». Урожай в ЄС знову скоротили, тепер на 4 млн тонн до 124 млн тонн, «через несприятливу погоду у Франції та Німеччини».

Світовий експорт пшениці у 2024/25 МР підвищено на 1,7 млн тонн до 216,5 млн тонн. Покращення перспектив торгівлі для України, Австралії та Канади компенсує скорочення для ЄС. Український експорт підвищено на 1 млн тонн до 15 млн тонн, що все ще нижче 16,2 млн тонн, встановлених як експортний ліміт. Експорт Австралії підвищено на 2 млн тонн до 25 млн тонн, а Канади - на 1 млн тонн до 26 млн тонн. Прогноз для ЄС зменшено на 2,5 млн тонн до 31,5 млн тонн через скорочення врожаю.

Світове споживання у 2024/25 МР було збільшено на 0,9 млн. тонн до 804,9 млн тонн.

Прогноз світових запаси на кінець 2024/25 МР було збільшено на 0,6 млн тонн до 257,2 млн тонн, «оскільки підвищення для Канади, Бразилії та Казахстану компенсувало скорочення для Австралії, Туреччини та кількох інших країн». Ця цифра все ще є найнижчою з 2015/16 МР, але вища за середні очікування ринку у 255,3 млн тонн. Зокрема, американські запаси залишилися без змін, тоді як ринок чекав на невелике зниження.

Загалом звіт є нейтральним, без зниження запасів у США та зі світовими стоками вище середніх очікувань. Усі зміни у прогнозах врожаїв не стали несподіванкою. Усі очікування зараз сконцентровані на Австралії, де польові роботи ще не закінчено.

Прокоментувати